My Automatic Loan Payment Machine

The Personal ATM That Makes My Loan Payments

“My mission is to invest in income generating assets that will fund my lifestyle.”

Living the Dream

We all do it!

The system has programmed us to borrow it whenever we think about making a purchase.

Sometimes we borrow large amounts.

Other times, we borrow small amounts.

Its borrowing money!

Let’s stop for a moment and examine our lifestyle:

We borrow money to buy a car.

We borrow money to buy a home.

We borrow money to make repairs and/or remodel our home.

And the list goes on!

The Money Source

We instinctively turn to banks and credit cards, when we want to borrow money. It’s easy to finance our way through life.

There’s one major condition, when borrowing money.

Paying the money back…with interest.

In this post, I’m going to expose you to a system that I am using, to payback loans without working another job or side hustle. A simple system that you can setup in a weekend.

A simple payment system that you can manage from your tablet and/or phone.

Key Takeaways

Only 3 components in this system.

Learn the concept of how money flows.

Learn how to link financial accounts together.

Direct dividend income to make loan payments from your phone or tablet.

So let’s dive right in!

The Big Idea

My automatic loan payment system leverages income generating assets to make monthly loan payments. Simply put, as my investments generate income, I use the income to pay down my loans.

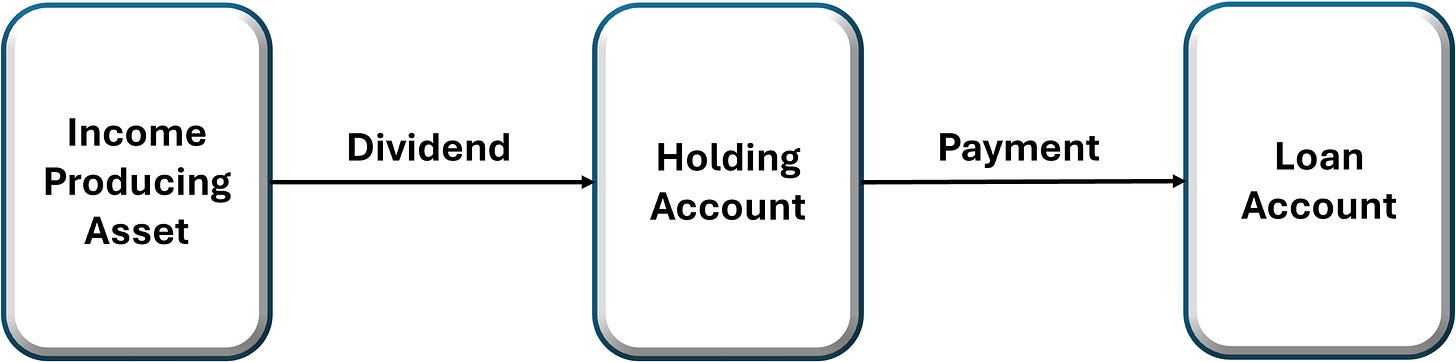

The system is made up of three components.

The Income Producing Asset

The Income Producing Asset is the main component. The assets job is to produce passive income.

Examples of Income Producing Assets:

Dividend Stocks

Options ETFs

Physical Real Estate

Website with Affiliate Links

Holding Account

The Holding Account is a bank account, that holds the dividend payouts. Its function is to gather all the dividend payments.

The Holding Account allows me to separate my dividend pay outs from the brokerage funds, so it doesn’t get spent on buying more equities. It could be a checking/savings account, or a high-yield savings account.

Loan payments are made from this account.

Loan Account

The Loan Account is the debt borrowed from a lending institution. This account includes information such as payment history, loan principal, remaining balance, and monthly payment amount.

The Payment System Concept

The diagram below shows how the three components are connected.

In my system, the Income Producing Asset is held in a taxable brokerage account. Brokerage accounts act similar to bank accounts.

Each account listed above has the following:

Account Number

Routing Number

Link each account in the direction as shown in the diagram above. Financial institutions make it very easy to link accounts.

Lets take a look at my results.

The Loan Payoff Results

My objective is to pay down my loan balance to $0, using the dividends I've earned, year-to-date in 2025.

Starting account balances:

Loan Account Balance: $2,045

Total dividend payouts from April to July: $1,852.70

Holding Account Balance: $54.08

Payoff Results

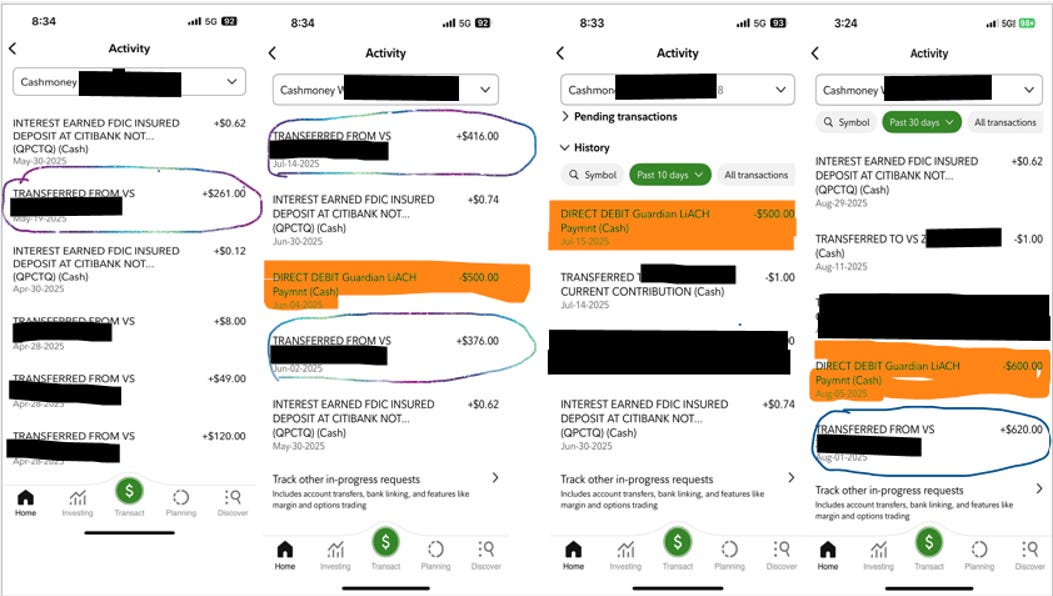

Starting in April 2025, I transferred the dividends earned to the Holding Account. The total transfer from April through July 2025 was $1,850.00 USD.

Once the transfers settled in the Holding Account, I made the following loan payments:

June Payment - $500

July Payment - $500

August Payment - $600

After all my payments were posted, my remaining balance is approximately $445.

Still think this is far fetched?

Keep reading, I'll break this down even further.

My Automatic Loan Payment System

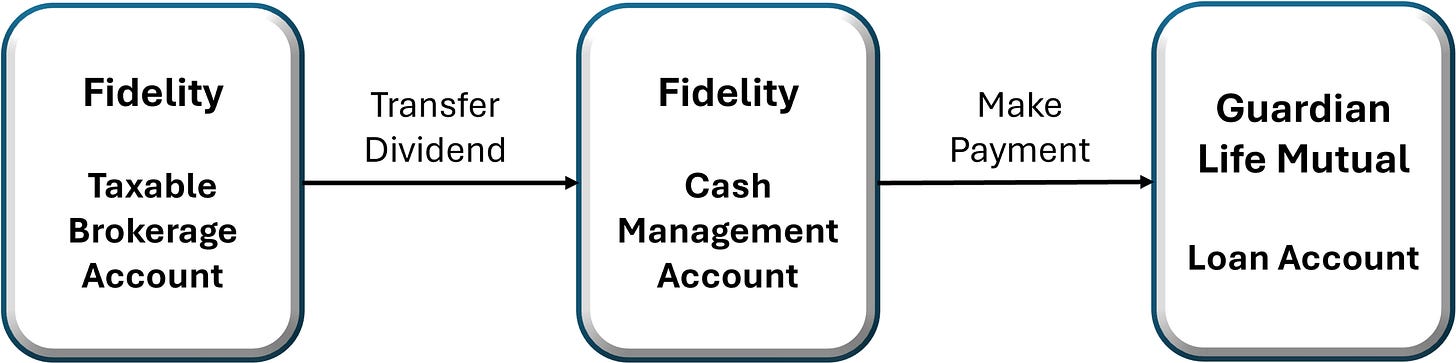

As mentioned before, my system has 3 components. The flow diagram below shows the exact accounts that I use.

Fidelity Taxable Brokerage Account

This is the main account. I use to buy and sell the income producing assets. My income generators are individual stocks and Options ETFs.

My income generators:

Options ETFs - dividends paid weekly and monthly

REITs - dividends paid monthly

Business Development Companies - dividends paid monthly and quarterly

Dividend Payments Received

April 2025 Dividend Earnings: $261.40

May 2025 Dividend Earnings: $376.57

June 2025 Dividend Earnings: $415.66

July 2025 Dividend Earnings: $620.48

YMAX and CONY have paid out the most dividends in the short time I’ve held them. For all the positions in this account, the dividend reinvestment setting is turned off.

Moving Money

When dividends are payed out, they get deposited into the default fund (SPAXX). At the end of every month, I tally the total dividends earned and transfer them to my Fidelity Cash Management Account.

Since both accounts are with Fidelity, I can easily transfer the funds using their mobile app. The transit time is less than 1 min.

Fidelity Cash Management Account

I use this account as the “middle man”. Dividend payments are transferred in and out of this account for ease of tracking.

When dividend payments have settled in the taxable brokerage account, I transfer the monthly totals into this account. The screenshots below show each of the dividend transfers I made in this account.

Starting Balance = $54.08

Deposit Dividends Received from January 2025 to March 2025 = +$177

Deposit Dividends Received in April 2025 = + $261

Deposit Dividends Received in May 2025 = + $376

Deposit Dividends Received in June 2025 = + $416

Deposit Dividends Received in July 2025 = + $620

Total Deposits = $1,850.00

Total Account Balance = $1,904.08

I personally value the speed of money, more than the return, for this system. Waiting a few days for money to transfer between banking institutions can make all the difference in the world, when investing.

Having multiple accounts at the same banking institution significantly reduce the transfer time. It’s seconds vs. days.

Guardian Life Loan Account Pay Off Results

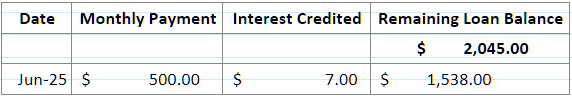

The Guardian Life loan is a loan from the cash value component of a whole-life insurance policy. The interest on the loan is 7.47% APR. We will walk through the loan payment transaction and the loan balance reduction.

The starting balance for the loan account is: $2,045

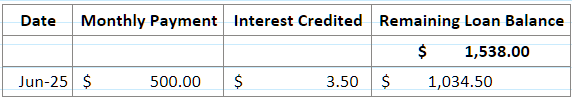

In June 2025, I made a $500 payment to the loan. Loan balance was reduced as follows:

In July 2025, I made a 2nd $500 payment to the loan, further reducing the loan as follows:

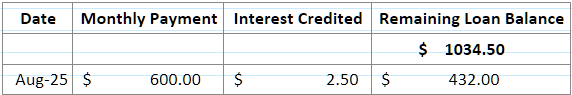

In early August 2025, loan payment was increased to $600, due to an increase in dividends earned.

Here are the results:

Final remaining balance: $432.00.

In the early September 2025 time period, I plan to make the last loan payment, getting me to the $0 loan balance.

Linked Accounts

My Fidelity Cash Management account is linked to my Guardian Life account, as a payment method.

I used the Fidelity Routing and Account numbers to make the connection. Takes about 5mins to setup.

In the screenshots above, you can see the payments withdrawn, highlighted in orange.

Moving Forward

I’ve always envisioned using passive income to fund my lifestyle. A theory, that has been floating in my mind. This case study proves it can be done. By investing in dividend paying stocks and Options ETFs, you can electronically route your dividends to make loan payments.

I used my Guardian Life loan for this case study to keep it simple. In the future, I can replace this loan with a variety of other debt balances:

Car Loans

Credit Card bill

Mortgage

…and that is my objective.

The next step is to analyze my stocks and Options ETFs holding to increase my dividend income. I’m targetIng $1,000/mo in dividend income.

What actions do I need to take to reach my target?

Stay tuned…there’s more to come!

Take Action

This loan payment system is simple. You can build your own in a couple hours.

Here’s 4 Easy Action Steps:

Step 1: Drawing a map of how you want your dividend income to flow. Identify your starting point and your final destination account. Don’t overthink this.

Step 2: Invest in a few dividend paying stocks and ETFs.

Step 3: Collect dividends and transfer $1 of dividends earned, to Holding Account

Step 4: Schedule a loan payment for $1. Sit back and watch the money flow.

I hope this was helpful to you.

See you in the next post.

PS. Before you go, If you’re serious about building steady, predictable cash flow from dividends, this guide is the best place to start.

Cain LC has curated a research-backed list of WEEKLY & MONTHLY paying option ETFs, designed to help you create reliable income every single month.

Click here to check it out

Steve, love the simplicity of your system! Leveraging dividends to automate loan payments is brilliant. While I don’t have debt, this concept of using passive income to cover living expenses is something I’m very interested in. It’s a great example of how investing can work for you — not the other way around. Keep it up!